Do Mil ao Milhão - Thiago Nigro

Discover how to make your money work for you and get able to truly enjoy your life!

Add to Favorites

Add to read

Mark as read

Have you ever felt that you are failing to make money? Or maybe, that you are losing money?

Being able to make your money "work" for you is critical to ensure the growth of your financial legacy and your wealth. Successful investors know this, and that's the way they can mitigate the risks to profit opportunities.

In addition, they have great market knowledge, what enables to make good investments once they know how and where to invest to achieve the highest possible financial return.

Thiago Nigro will show you how to go from a Thousand to a Million!

About the book "Do Mil ao Milhão"

The book "Do Mil ao Milhão", is an original work written by Thiago Nigro that contains 222 pages described in a simple and easy way to read, very rich in content.

This book, published by Editora Harper Collins in 2018, guides the reader about the three pillars for achieving financial independence: spending well, investing better and earning more.

With the proposal of uncomplicating the concepts about investments and financial market, this work will make everyone capable of getting their first million.

About the author Thiago Nigro

Thiago Nigro is a brazilian educator and youtuber focused on the area of finance and investments. He is known on the internet as "The Rich Cousin" (O Primo Rico), which is also the name of his channel on YouTube.

Today, the channel "O Primo Rico" has up to 60 million views in his channel and carries the mission of talking about money in an uncomplicated way and also making all investors retire sooner, and of course, much richer!

To whom is this book indicated?

The book "Do Mil ao Milhão" is indispensable for those who are seeking to obtain and also broaden their knowledge about the disciplines of finance and investment, regardless of their training or professional position.

Main ideas of the book "Do Mil ao Milhão"

- Learn how and where to invest your money efficiently;

- Achieve financial independence;

- Changing paradigms and mindset about financial investments;

- Information, education and encouragement for personal development;

- Financial market of variable income;

- How to reach the first million.

This summary will introduce you to the top teachings about how to become a millionaire!

Download the "Do Mil ao Milhão" Book Summary in PDF for free

Do you have no time to read now? Then download the free PDF and read wherever and whenever you want:

Overview: Introduction

In the beginning of his book, Thiago Nigro raises several types of investment's data regarding the most diverse applications of the market.

Besides he emphasizes that the biggest problem in humanity are, the fear of risk exposure and the lack of information and solid knowledge about investment.

He also states that brazilians believe that due to the economy it's impossible for a random person to become a millionaire. To stop this belief he will how how it's not difficult, but laborious.

Nigro highlights that he didn't met anyone who got rich without working hard.

At the end of the introduction, there is a list containing the six sacrifices to be rich, and they are:

- Sacrifice comfort;

- Sacrifice the balance;

- Sacrifice mediocrity;

- Sacrifice the will to be loved;

- Sacrifice the fragility;

- Sacrifice perfectionism;

Thiago states that evolution does not happen in comfortable and controlled environments. Therefore, to achieve success we must overcome all adversities, taking on sacrifices and transforming them into opportunities of improvement.

Overview: First Pillar - Spend Well

The author, in one chapter says to the readers to get rich, but not in this moment. So you may ask yourself, this book should help us to get rich, why can't I get rich now? The answer is simple, like everything in life, things don't happen so easily.

It's explained that people need to learn in a gradual way, giving only necessary steps, avoiding premature fatigue. This way the result will come naturally.

Nigro also explains that in order to deal optimally with money, discipline, commitment, involvement and study are needed! And for that is essential that you change your mindset about finances!

In this book, the author explains the mindset of three types of people: aspirant, speculator, and investor.

Aspirant

It's the one that doesn't think about investing but in saving. This people also don't recognize and aren't aware of the importance of investing what they earn.

Speculator

It's the one who considers himself an investor but trades stocks based only on their price. They faithfully believe that it needs luck to be part of the stock market, as if it were a "game of chance".

Investor

It's someone that trades stocks based not on its momentary price, but based on the fundamentals of the company to which it's planned to invested, such as trend, market range and growth rate.

They recognize that investment results are long-term and that operations over short periods of time may have excessive costs. This people also understand mathematical tools well, especially compound interests and its relevance to financial investments.

Besides, they focus and invest their money thinking about old age and retirement.

Financial Anamnesis

In order to not become a speculator or stand in the way of a aspirant, Nigro portrays that it's necessary to make a diagnosis of your money in advance.

This helps you separate what works well from what doesn't, and still allows you to identify the changes to be made.

The four financial phases

The author also demonstrates that another way to complement your financial diagnosis is identifying the financial phase in which you are:

- In debted: who is in this phase needs to adopt strategies to save money, that can be buying cheaper things, renegotiating debts or even making part-time jobs to increase income;

- Little Investor: a person who earns a little more than spends. If you are here, you are beginning to create equity. Be aware of it and know what you are doing to avoid wrong decisions;

- Long-term focus: a person that focus in the future. It's someone who answers yes to all the questions from the table given in the book;

- Financial Freedom: a person who can enjoy impulses whenever wishes. Having reached stability (not wage dependency), you can even take risks when starting a peculiar venture.

Starting Point

In the book "Do Mil ao Milhão" you learn that there is no single rule, ready formula or law when it comes to budgeting. That way, a starting point for you to organize your financial life is putting a goal of saving 50% of your income.

The author acknowledges that working with percentages rather than numbers themselves is a tricky task, because the real value may not fit the financial needs of all people in general.

But he also states that having a break in your budget is indispensable. For that, Nigro suggests a basic division of spending as follows:

- 50% for essential expenses;

- 10% for non-essential;

- 30% for investments;

- 10% to spend in a free way (it is important to reserve a part of our money for fun and also for our pleasures).

Overview: Second Pillar - Investing Better

Performing Realistic Projections

Thiago Nigro comments that the decision to invest or not should be based on a realistic projection that aims to verify if an opportunity is feasible.

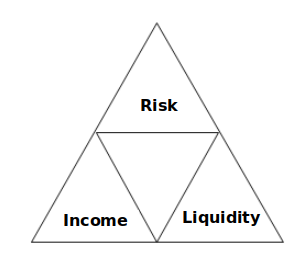

The author presents a comparative formula for investments, which is based on a triangle, called by him of "Triangle of Nigro", that is subdivided in 4 smaller triangles. The superior one is the "Risk", the one on the right is "Liquidity" and on the left is "Income":

SOURCE: Adaptation of the triangle presented by the author on page 86.

Nigro explains that the edges of the triangle need a very intimate relation with each other, as follows: if the investment has a certain risk, what is the benefit on income and liquidity in assuming this risk?

Thiago cites the example of an investor who enters the Stock Exchange, where the high risk is offset by the possibility of better profits.

An example of common risk in investments is the so-called herd effect. Not always following the market is the ideal choice.

The author portrays the example of the company MNDL3 which had a large increase in its stock within a short period of time and soon thereafter surprised several greedy investors with an equivalent recession.

The sooner, the better

Do you know when is the right time to start investing? Well, the title of this topic has already given you that answer. That way, it's clear that the longer you take to start investing, the more "expensive" it gets to retire.

The book proves, through math, that if a person take a year to invest its money at a certain tax, they fail to earn a good amount of money by collecting the final quantity at the end of an application period, which is a short scale.

You can be asking now, I know I need to start as soon as possible, but where?

During the second pillar, Thiago describes several possibilities for investments, including the LCA, LCI and Direct Treasury, Crypto-Coins and reaching Private Pension Plans.

All these types of investments are well detailed and supported by references and data.

In this summary, we will cite only the Direct Treasury, and the author will explain the reason.

Direct Treasury, the first investment

In this topic from the book "Do Mil ao Milhão", Nigro fully describes what the Treasury is, how to invest and what to expect from it.

The author explains the three main DT titles, noting that this is a good initial investment since it is easy to access and understand.

What is the Direct Treasury?

The Direct Treasury is a business plan of public bonds for individuals through the internet. The author justifies that government bonds are the assets with the lowest risk in the economy, so they are ideal to start investing.

Types of Direct Treasury

Basically what changes between types are the way in which investment develops over time:

- IPCA: public bond in which a fixed investment rate is associated with inflation plus interest;

- The Selic Treasury: title that is associated with the Selic rate; as well as the IPCA, the final value is subject to changes;

- Fixed-rate Treasury: defined and prefixed profitability at the time of purchase. In this title you know exactly the amount you will receive at the end of the application period.

The Power of Choice

Thiago says that despite presenting several investment choices possibilities, your money is something extremely personal.

That's why you decide what to do even being subject to mistakes and risks. It's important for your success to stay focused on your goals.

Overview: Third Pillar - Earn More

Right at the beginning of the third pillar, the author encourages you to run away from the traditional paradigms and emphasizes that they don't encourage innovation and creation. That's the reason he proposes to change your way of thinking in the first pillar.

Your life, your brand

The author portrays that those who earn more are people who work well their personal branding, that is, they make an advertisement of themselves, that transmits their personal mark. It can increase the visibility from your business.

He divides the personal brand into: talent, experience, qualification and positioning.

Eight Learning

In the end of the book "Do Mil ao Milhão" Thiago Nigro presents us 8 important reflections that must be carried into our lives if we want to reach higher positions in the market:

- (BE CAREFUL) You will want the easiest way!;

- Opportunity may come in disguise;

- Work to learn;

- Make use of a Scale (do more at the same time, without spending extra features, be productive);

- Have processes (divide your functions and actions);

- Read books;

- Believe in people;

- Develop a master mind and in harmony with the environment (cooperation through effort and knowledge of a team to achieve a goal);

Finally, he states that the biggest risk is not to take any, because in a world as we have today, the only way of surely failing is not to take risks.

What do other authors say about it?

For Robert Kiyosaki, author of the bestseller "Rich Dad Poor Dad", the journey to enrichment should begin as early as possible, and it consists of evaluating your finances, setting personal goals, and getting the knowledge needed to achieve your goals.

According to author Lynda Gratton of "The-100-Year Life", long-term financial planning is needed, with a belief in your skills and self-control for savings and investment plan.

Finally, for the author of "Think and Grow Rich", Napoleon Hill, the first step to become rich is to have a strong desire to be rich. This desire has to be a real skin in the game and possess a good deal of persistence.

Okay, but how can I apply this to my life?

Despite being a topic covered in the second pillar of the book, the topic Earn Lifetime sums up the real purpose of the author in relation to his work.

Did you like this summary of the book "Do Mil ao Milhão"?

If you enjoyed this summary write a comment, your feedback is very important to us!

Did you identify yourself with the book's ideas? You can buy it just clicking on the image below!